In July 2020, Michigan’s auto insurance laws will change with the auto insurance reform. The state will no longer mandate that everyone with auto insurance have full No-Fault coverage!

The No-Fault coverage in Michigan is what pays for 100% of medical bills relating to catastrophic auto accidents. It is also the main reason why Michigan has the highest auto insurance rates in the country.

One of the major changes to the law is that it allows people to opt out of this coverage or reduce the amount of coverage they possess which can help save money on premiums.

It’s important to understand the full situation though as it’s not as cut and dry as you might think.

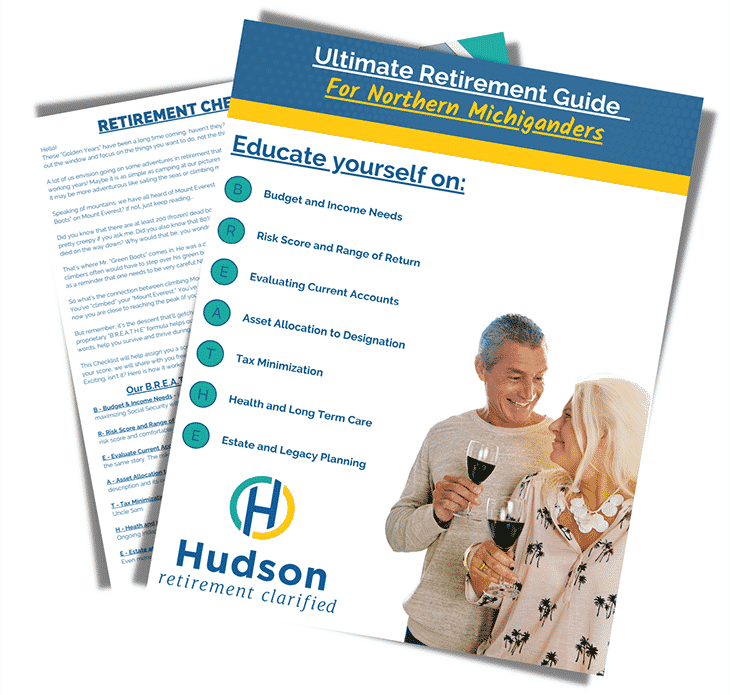

At Hudson Wealth Management, we specialize in Medicare planning. You might be asking yourself, if I have Medicare, which offers a wide variety of generous benefits, can I save money on my auto insurance premiums by opting out of No-fault?

Here’s what you need to know about Medicare and Michigan’s Auto Insurance Reform:

1. It’s true that Medicare will cover your medical bills if you’re in an auto accident, but it’s more complicated than that. Medicare does cover auto accident related injuries in Michigan, but unlike no-fault insurance, it won’t cover all vital medical care services that someone in a car accident might need. Also, it will only cover auto accident related injuries if the persons involved completely opt out of Personal Injury Protection coverage. Therefore, in order to save money on auto insurance premiums you have to fully opt out PIP in order for Medicare to cover you in an auto accident. By law, Medicare is the secondary payor to no fault coverage in cases of auto accidents.

2. So there are savings for people with Medicare coverage if they choose to opt out of PIP (Personal Injury Protection coverage), but the downside is that Medicare covers auto accidents more comprehensively than auto insurance would. Accident victims with PIP coverage desperately need care, recovery, and rehabilitation services which are all covered by automotive no-fault coverage, but not by Medicare.

3. Medicare specifically does not cover:

-

In-home attendant care

-

Transportation to and from medical appointments

-

Vehicle modifications

-

Home modifications

-

Case management services

-

Residential treatment programs

-

Long-term and custodial care

-

Replacement services

-

Skilled nursing facility care

-

Electric wheelchairs

-

Occupational therapy

-

Executive functioning therapy for post-traumatic brain injuries

-

Mostly importantly: Long-term comprehensive rehabilitation

Especially if someone is in a weaker state to begin with, some of these covered benefits may be necessary if they are in an auto accident. Consult an insurance advisor to find out if opting out of PIP coverage is right for you. Call us today at 231-421-7391 for a free consultation.