Video Series – #2 – If you have a Medicare Supplement(Med Supp), this is one tip that can be used more than once and for most people will add up to thousands of dollars in savings.

If you would like further information on your Med Supp, planning for or reevaluating your retirement, or simply want to chat, give us a call at 231-421-7391.

Tip #2 Med Supp Premiums

Hey all you Michiganders out there on Medicare! Sara Hornick here, I work at Hudson Wealth Management in Traverse City and recently I have been doing some tips for you for Medicare for 2021! These tips could save you thousands! They have saved a lot of my client’s money over the past 10+ years.

So, last time, we talked about calling pharmaceutical companies for those of you who have some pretty hefty prescriptions that your Part-D plan is not necessarily taking care of. That was tip #1.

Tip #2 is, comparing your Medicare Supplement (Med Supp) Premium every 2-3 years.

Now, those of you who have been on Medicare, you know how those supplements work, right? They are all standardized by the federal government, which means, that the coverage does not change from company to company. That is why I quoted Gertrude Stein who said, “A rose is a rose is a rose..”. And what she meant by that is that it is a rose, there is no difference! So, Plan G, that is me saying “A G, is a G, is a G..” right? Because it does not matter what company you go with, if you have a Plan G, you are going to have that exact same coverage. So, why pay more for the exact same coverage?

Why Switch?

Now, a lot of you think that switching is not necessarily a good idea. However, really it is because every year that you keep the same companies Plan G (for instance), you are going to probably see a rate increase. The longer you keep with that same company, the higher those premiums are going to increase. So, by comparing and getting into a different company with the same coverage, you are always going to be keeping your premium as low as it can be, right?

Now that is why you need to be dealing an independent agent! Did you know that there are 48 companies in Michigan that offer Medicare supplements (Med Supps)? That is pretty surprising, isn’t it? In working with an independent advisor, such as the advisors at Hudson Wealth Management, you are going to have access to all of the top companies in Michigan. We do not go with the fine, alright guys, we go with companies that have a long-standing history of service, stability, and praise! Companies like Priority Health, Blue Cross Blue Shield, Humana, Mutual of Omaha, TransAmerica, Aetna or Cigna. Those are companies that are very solid, they have been around for a long time, and they are going to be able to offer you that same great coverage but probably for a lower premium than what you are paying right now.

Caveat

One other caveat, some of you may be saying “I am diabetic, I can’t switch.”, “I have A-FIB, I can’t switch.”, “I have COPD, I can’t switch”. Well, you know what? This other benefit of working with an independent agent, is that often times, one company won’t be very diabetic friendly, for underwriting purposes, but another company will! We usually can find you coverage and at a lower price than what you are paying now.

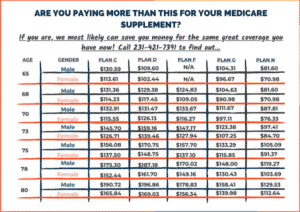

So I wanted to show you this little chart here:

What you can do, is pause the screen or go back to it after we are done watching, and find your plan, find your age, find your gender, and if you are paying more than what is listed there for your supplement, you need to give us a call! You really do! You should not have to be worrying about how to pay for your Medicare Supplement (Med Supp), or that the premium just keeps going up. That is one thing that you should not have to worry about. What you should be worrying about is making plans with your friends on the beach! That is what your retirement is supposed to be about, about having a good time!

So, give us a call, we will be happy to do a complimentary review for you. Just to go over your options to see if we can get you the same coverage, maybe even better coverage, for a lower premium. It is worth the call, I promise we would love to help you out!

Until I talk to you next time, have a great day!